10 Books to Read if You Love Layered Money

Nik Bhatia’s Layered Money (2021) has become a landmark book for anyone interested in the structure and history of money. It explains how money isn’t just a single entity but a system built in hierarchical layers. From ancient gold reserves to today’s revolutionary digital currencies like bitcoin, Layered Money traces the evolution of monetary systems in an accessible and insightful way. This approach attracts readers intrigued by finance, economics, and the complex history of money, including how new technologies are re-shaping financial landscapes.

If you found yourself captivated by Layered Money, this blog post is for you. Here, we share 10 books to read if you love layered money—a curated guide that deepens your understanding of monetary evolution, bitcoin economic history, and the layered nature of money. These books like Layered Money offer sharp insights into the past, present, and future of financial systems, making this list a must-read for keen followers of financial evolution books and monetary layers.

What Are These Book Recommendations Based On?

The selection of these 10 financial evolution books is purposefully grounded in the core themes that make Layered Money so compelling. Central to the list is the exploration of how financial systems have historically evolved, the concept of money as a layered construct, and the transformative emergence of cryptocurrencies like bitcoin.

Each title balances foundational monetary history with the innovative developments of the digital age. Some works focus on precious metals, the rise of credit, and central banking layers—the established pillars of monetary theory. Others shine a light on cryptocurrencies and decentralized finance as the newest elements altering money’s layered structure.

The books delve deeply into bitcoin economic history to explain its role as a disruptive monetary layer, while also unpacking broader monetary theory. This thoughtful mix offers readers a comprehensive perspective on financial transformation, making the list an essential companion to Layered Money.

Keywords such as financial evolution books, bitcoin economic history, books about monetary layers, and books like layered money naturally frame this reading guide, ensuring it aligns with interests sparked by Bhatia’s work.

List of Recommended Books

1. The Bitcoin Standard by Saifedean Ammous (2018)

Genre: Economic History / Cryptocurrency

Themes: Monetary evolution, bitcoin as digital gold, sound money principles

One-Sentence Review: A foundational book analyzing bitcoin’s historical significance within the evolution of monetary layers.

What you can expect:

- A deep exploration of monetary history, emphasizing gold’s function as the ultimate hard money layer.

- A critical examination of fiat currency failures and their impact on modern monetary structures.

- A rigorous argument presenting bitcoin as an emergent, superior “hard money” layer within the financial ecosystem.

- Insightful contrasts between centralized traditional money and decentralized, blockchain-based monetary layers.

The Bitcoin Standard is essential for readers seeking a historical and theoretical grounding in bitcoin economic history. It complements Layered Money by placing bitcoin as the next evolution in the layered hierarchy of money, skillfully bridging traditional sound money concepts and the future of digital currencies. This is one of those books like layered money that enriches your understanding of financial evolution books with a crypto focus.

2. Money: The Unauthorized Biography by Felix Martin (2013)

Genre: Economic History / Popular Economics

Themes: Social origins of money, credit evolution, financial innovation

One-Sentence Review: A sweeping narrative challenging the usual notions of money as just a commodity, emphasizing its social and credit-based origins.

What you can expect:

- A redefinition of money as a social technology rooted in credit and mutual obligations rather than barter or gold alone.

- Critical deconstruction of myths—including the idea that barter preceded money and the dominance of gold.

- Extensive coverage of credit systems that underpin monetary layers beyond physical currency.

This book broadens the lens with which you view books about monetary layers. Felix Martin’s accessible approach expands the concept of money’s foundation beyond commodities into social and financial contracts. It’s a vital companion to Layered Money, enriching the dialogue around the origins and evolution of layered monetary systems and fitting perfectly among top financial evolution books.

3. Debt: The First 5,000 Years by David Graeber (2011)

Genre: Anthropology / Economic History

Themes: Origins of debt, monetary customs, credit systems

One-Sentence Review: An anthropological exploration revealing how debt and credit formed complex social and monetary systems well before the advent of coins or banknotes.

What you can expect:

- An insightful historical view on how credit relationships preceded and shaped money’s development.

- Cross-cultural analysis on how debt and obligations structured early societies.

- A broad time frame offering deep context on monetary evolution and the layers formed by social contracts.

Graeber’s work is a cornerstone for understanding the social and anthropological layers underlying money, going beyond physical coins and bills. It links well with the layered structure philosophy in Layered Money, delving into foundational credit mechanisms. Its profound insights make it a must-read among books about monetary layers and enrich the discussion around bitcoin economic history in terms of credit transformations.

4. Lords of Finance by Liaquat Ahamed (2009)

Genre: Financial History / Biography

Themes: Central banking, interwar financial policy, monetary crises

One-Sentence Review: A compelling narrative of central bankers whose policies and decisions shaped the global financial layers during tumultuous times.

What you can expect:

- A biographical approach revealing the personalities behind major interwar central banking decisions.

- Detailed accounts of how gold standards and central banks intertwined to create layered financial frameworks.

- Critical lessons learned from the monetary crises of the early 20th century that continue to influence today’s layered money.

Lords of Finance provides vivid historical context for understanding central banking’s role in building the middle layers of money systems. It enhances insight into financial evolution books by linking past monetary layers with modern policy implications and makes a natural bridge for readers of Layered Money exploring the institutional layers of money.

5. Digital Gold by Nathaniel Popper (2015)

Genre: Technology / Financial History

Themes: Bitcoin history, innovation, monetary paradigm shifts

One-Sentence Review: A narrative-driven chronicle uncovering bitcoin’s rise through the eyes of its pioneering individuals.

What you can expect:

- First-hand accounts and profiles of key figures in bitcoin’s creation and early adoption.

- Exploration of trust, decentralization, and disruption in monetary systems.

- Illustration of the layering concept by introducing bitcoin as a new digital monetary layer.

Popper’s Digital Gold is an engaging companion to Layered Money that demystifies bitcoin economic history with storytelling flair. As a book about monetary layers, it provides a real-world look at the creation of new financial strata in the digital age, making it a perfect addition to this list of books like layered money.

6. The Ascent of Money by Niall Ferguson (2008)

Genre: Financial History

Themes: Financial innovation, historical development of money and markets

One-Sentence Review: A comprehensive history of money’s ascent from ancient times to modern innovations including blockchain technology.

What you can expect:

- Episodic examinations of financial tools such as bonds, banking, bubbles, and derivatives.

- Clear, insightful explanations of how money evolved through various layers across history.

- Connections drawn between historical monetary mechanisms and the layered digital currencies of today.

Ferguson’s panoramic approach enriches understanding of money’s layered evolution. Positioned among financial evolution books, it complements Layered Money by covering a broad sweep of monetary development and providing context for the addition of new digital layers like bitcoin.

7. Currency Wars by James Rickards (2011)

Genre: Economic Policy / Financial History

Themes: Geopolitical monetary conflict, financial strategy, currency manipulations

One-Sentence Review: A critical analysis of global monetary power struggles that shape the layered hierarchy of currencies.

What you can expect:

- In-depth case studies on historical and ongoing currency conflicts.

- Analysis of monetary policies’ impacts on global financial stability.

- Insight into how currency power dynamics impact the structure and resilience of monetary layers.

Currency Wars provides strategic insights into the risks and tensions underlying monetary layers. As a financial evolution book, it reveals how geopolitical factors influence the layered money system, enhancing the framework that Layered Money introduces and making it relevant for readers seeking to understand structural vulnerabilities.

8. The Age of Cryptocurrency by Paul Vigna & Michael J. Casey (2015)

Genre: Technology / Financial Trends

Themes: Cryptocurrencies, blockchain, digital disruption in money

One-Sentence Review: An accessible explanation of how bitcoin and digital currencies are redefining money’s structure.

What you can expect:

- A layman-friendly breakdown of blockchain and cryptocurrency technologies.

- Examination of how new digital currencies build on and disrupt traditional monetary layers.

- Discussion of impacts on privacy, finance, and global economic systems.

This book works as a primer for understanding bitcoin economic history through the lens of emerging technologies. It complements Layered Money by clearly illustrating how cryptocurrencies form new layers within money’s hierarchy, making it one of the essential books like layered money for modern financial readers.

9. The Origins of Money by Carl Menger (1892)

Genre: Economic Theory / History

Themes: Market-driven emergence of money, spontaneous order, monetary layering

One-Sentence Review: The foundational economic treatise explaining how money naturally evolves in market systems.

What you can expect:

- Theoretical clarity on money as a product of market forces rather than imposed authority.

- Explanation of the layering effect as money emerges from barter to more complex forms.

- Enduring relevance for understanding both traditional monetary history and modern layered money concepts.

Menger’s classic lays the theoretical groundwork for all books about monetary layers and financial evolution books that follow. For readers who loved Layered Money, this book offers essential insights into the natural stratification of money and remains key to understanding monetary systems in a theoretical context.

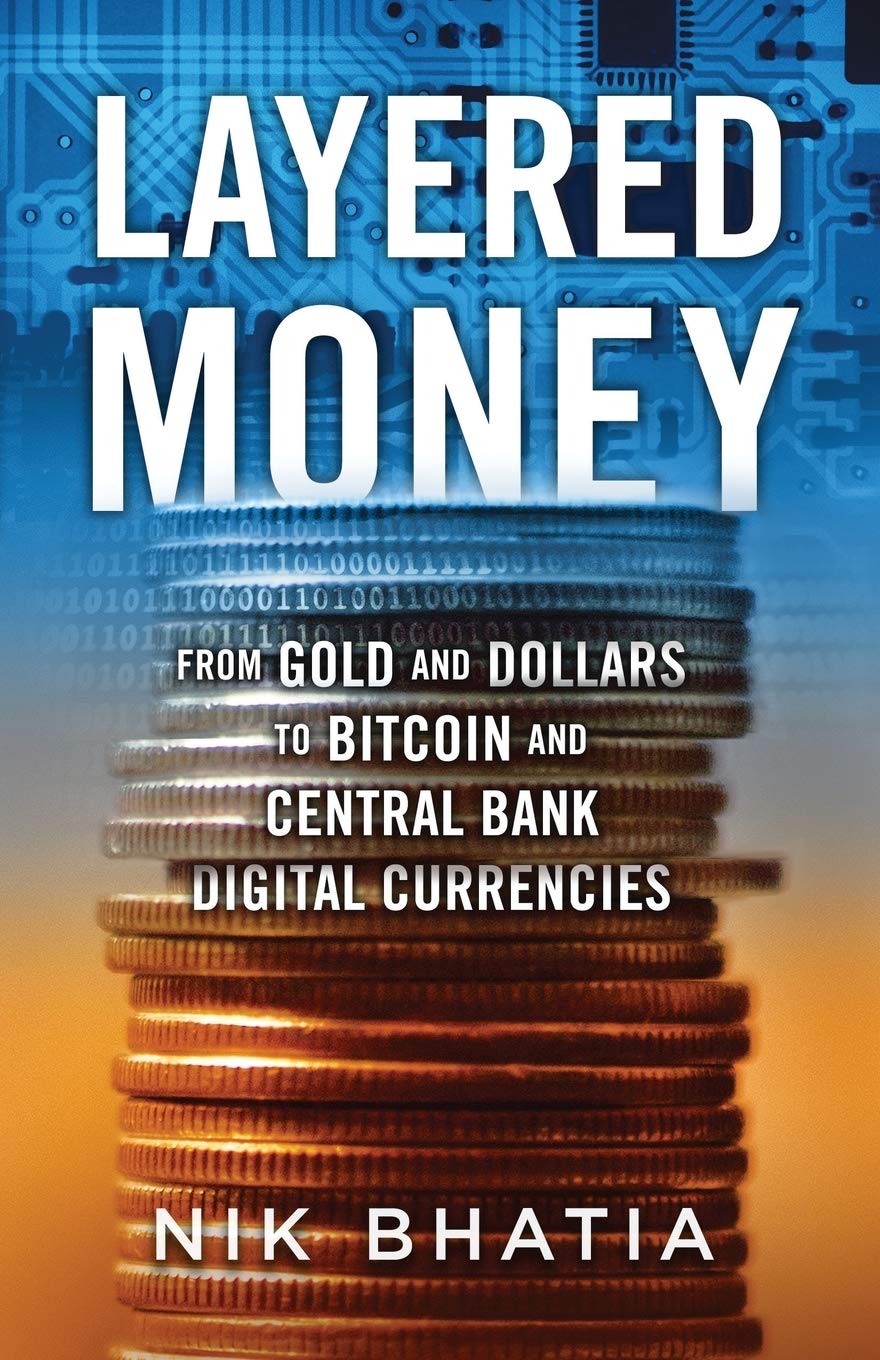

10. Layered Money by Nik Bhatia (2021)

Genre: Finance / Monetary Theory

Themes: Monetary hierarchy, digital transformation, bitcoin economic history

One-Sentence Review: An innovative framework explaining modern financial systems through the lens of money’s layered history and digital evolution.

What you can expect:

- A detailed exploration of monetary hierarchies from gold to central banking to cryptocurrency.

- User-friendly explanations linking historical monetary layers with emerging digital assets.

- Analysis of how bitcoin fits into the evolving monetary strata as a new and transformational money layer.

Layered Money is the conceptual backbone for this entire reading list. Its accessible yet deep treatment of monetary layering and bitcoin economic history sets the standard for understanding financial evolution books. For any reader fascinated by money’s layered nature, Bhatia’s book remains an essential and inspiring guide.

Conclusion

For readers who loved Layered Money, these 10 books to read if you love layered money open many new doors into the world of monetary history and financial evolution. Together, they provide a multi-dimensional perspective that spans the origins of money, the social and theoretical foundations of credit systems, the critical roles of central banking, and the disruptive emergence of bitcoin and other cryptocurrencies.

This curated collection of financial evolution books connects the dots between traditional monetary layers and the new strata formed by blockchain and decentralized finance. Readers gain comprehensive insight into bitcoin economic history and the continuing story of layered money, enriching their understanding of both the legacy and future of monetary systems.

Ultimately, these books about monetary layers serve as a bridge linking the past, present, and future of money. For anyone captivated by the concepts introduced in Layered Money, this list is an invaluable resource to deepen knowledge and navigate the complexities of layered financial systems in an ever-evolving world.